June 28, 2024

Why Do Credit Scores Fluctuate?

Learn the Key Factors and How to Master Your Credit!

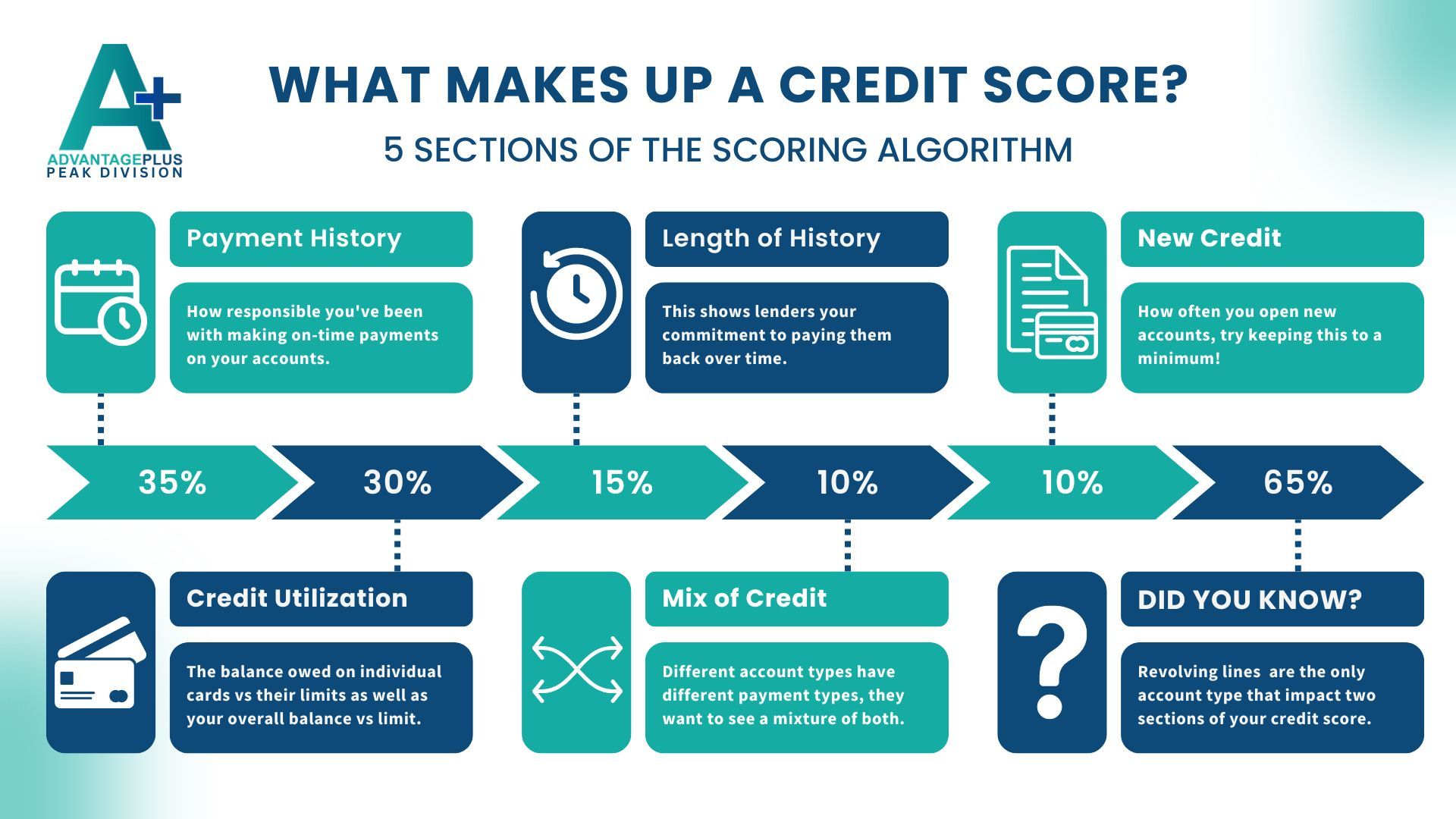

35% Payment History

- Your payment history has the heaviest impact on your credit scores and is a crucial factor when trying to obtain new credit. Making a late payment or missing a payment can have a severe negative impact and if you have an erratic payment history not only will your scores reflect your inconsistency but it's also a red flag for lenders.

30% Credit Utilization

- Your credit utilization ratio has the second largest impact on your credit scores. It measures the amount of credit you are using on your cards individually and combined, compared to your available limit for each card individually and combined. High credit utilization can result in lower scores and cause considerable credit score fluctuation.

15% Length of History

- This is how long your accounts have been open for, opening a new account or closing an older account impacts the average age of your credit, potentially causing your scores to decrease.

10% Mix of Credit

- The variety of account types you have such as credit cards, auto loans, personal loans or mortgages also play a role in determining your credit scores. Lenders like to see a mix of different account types because they function differently, a revolving line (typically credit cards) has a fluctuating minimum monthly payment due and an installment loan as a set monthly minimum payment due.

10% New Credit

- Each time you apply for new credit a hard inquiry is placed on your credit report even if you are not approved. One or two new inquiries in a short period of time typically won't have a significant impact on your credit scores, however multiples inquiries in a short period of time may cause your scores to drop. If you're shopping around for a new car or looking to buy a new home there is a 14-30 day grace period where they bundles all the inquiries together, you will still see each individual inquiry but they only count as one inquiry.

So what can you do to help minimize fluctuation in your credit scores and become a credit master?

1. Pay your accounts on time, most companies offer autopay which can be connected directly to your checking or savings account with your bank by providing your bank account number and routing number. Setting up autopay is often very easy, only takes a few minutes and helps to ensure your accounts are paid on their due date (or sooner) each month.

2. Keep your credit card balances under 30% of the limit, if you're looking for higher credit scores keep your balances between 5% and 10% as this will maximize the points you receive each month for your excellent credit utilization ratio.

3. Minimize the amount of new accounts you apply for and don't close your older accounts, it's better to keep them open and let them be closed organically than it is to jump the gun and close them on your own, which could potentially hurt your credit scores.